daliweb.site Gainers & Losers

Gainers & Losers

How Much Insurance Raise After Accident

According to the Consumer Federation of America, companies typically raise premiums by about 10% after a no-fault accident. Rates are raised much more if the. result of a surcharge for an accident or ticket, it is Comprehensive coverage is less costly than collision coverage so many people select a lower. Key Takeaways · Our study found rates after an accident can increase by $ per year, on average. · Taking advantage of discounts may help you save after a. After an at-fault accident, policyholders can expect insurance rates to rise by $ per year — that's an increase of almost 50% from the average rate without. Your car insurance rates should not increase after an accident unless you were at fault The factors determining how much your rates increase are your. Insurance companies increase rates after an accident because of risk assessment, looking at past claims, getting back some of the money they paid out. Your insurance premium will almost always go up if you cause an accident. Usually, insurers would charge extra for an accident if they were at fault. However. How Much Does Car Insurance Go up After an Accident? Your rates will typically increase when you're at fault in a car accident, since you'll be a higher risk. How much does insurance go up after a minor accident? Insurance does not go up much after a minor accident, if it goes up at all. In general, car insurance. According to the Consumer Federation of America, companies typically raise premiums by about 10% after a no-fault accident. Rates are raised much more if the. result of a surcharge for an accident or ticket, it is Comprehensive coverage is less costly than collision coverage so many people select a lower. Key Takeaways · Our study found rates after an accident can increase by $ per year, on average. · Taking advantage of discounts may help you save after a. After an at-fault accident, policyholders can expect insurance rates to rise by $ per year — that's an increase of almost 50% from the average rate without. Your car insurance rates should not increase after an accident unless you were at fault The factors determining how much your rates increase are your. Insurance companies increase rates after an accident because of risk assessment, looking at past claims, getting back some of the money they paid out. Your insurance premium will almost always go up if you cause an accident. Usually, insurers would charge extra for an accident if they were at fault. However. How Much Does Car Insurance Go up After an Accident? Your rates will typically increase when you're at fault in a car accident, since you'll be a higher risk. How much does insurance go up after a minor accident? Insurance does not go up much after a minor accident, if it goes up at all. In general, car insurance.

After an at-fault accident, policyholders can expect insurance rates to rise by $ per year — that's an increase of almost 50% from the average rate without. If your insurance rate is affected after an accident, you'll receive your new policy information and premium amounts about 30 days prior to the date your policy. Utah's average rate, on the other hand, goes up 40% for one at-fault collision. Most drivers in the Beehive State pay an annual insurance rate of $1,, which. For example, there may be an increase of 20–25% on your premium if someone is injured and you are the one at fault. This increase happens because you'll likely. On average, car insurance premiums go up 49%, or $ per year post-accident. There may be exceptions based on factors such as the state, insurance provider. In most cases, the driver who's found at fault for the crash will see their auto insurance premium increase, a practice known as surcharging. If you are that. Your insurance rate won't go up as a result of your first otherwise surchargeable, at-fault accident. Subsequent occurrences do not qualify for Accident. Again, car insurance premiums increase after at-fault accidents go up 46% on average and potentially even more than that in California. Rate increases will go. How Much Does a No-Fault Accident Raise Your Auto Insurance Rates? · USAA: $ · Nationwide: $ · GEICO: $ · State Farm: $ · Progressive: $ · Farmers. After a collision that was your fault, the accident will cause your insurance premiums to skyrocket. Nationally, the average increase in insurance premiums. However, because most comprehensive claims involve incidents beyond your control, you may not get an increase. How long do accidents stay on my insurance? Auto. Often after an accident with no accident forgiveness we would see a +% increase followed by two or more increases in the +% range. . Insurance rates typically surge by 49% following an at fault accident. For not at fault accidents, premiums can still rise by upwards of 10%. Being involved in. Generally, a no-fault accident won't cause your car insurance rates to rise. This is because the at-fault party's insurance provider will be responsible for. Generally, you can expect an increase of around 40 percent on average. A serious accident or a history of multiple accidents, however, could lead to more. Insurance companies view you as a higher risk after an accident, and they often raise rates as a result. However, the specifics depend on several key factors. Car insurance rates generally do not increase after a no-fault accident, but state laws and insurer policies may vary, sometimes resulting in unexpected rate. If you're the at-fault driver in an accident, your car insurance rates(opens in a new tab) will increase. The only exception is if you have an Accident Waiver . Arizona prohibits insurance companies from increasing auto insurance premiums for people who are not at fault for causing their accidents. An at-fault accident can cause a premium increase of 26% or more, depending on your insurance company.

What Happens If You Have A 401k And Change Jobs

Once your work with an employer ends, you can do a few things with your (k) plan. You could cash it out, roll it over to your new employer's (k). When you change employers, regulations make it easy for you to keep investing those savings tax-deferred, as long as you don't simply cash out. In addition. When you quit a job, your (k) stays where it is until you decide what to do with it. You can roll it over into your new (k), roll it into an IRA. If you are in a cash balance or (k)-type plan you will have the right to either leave your retirement money in your employer's plan when you leave the job or. Changing jobs is an exciting time, whether or not you're moving, and it can be a great opportunity to reevaluate what to do with your retirement savings. Other times, your money can't stay in the plan, and you need to take action, or your employer may move your money for you. The circumstances depend on the type. Yes. You can contact your previous brokerage company to transfer your k to your new k account. You can also roll over your previous k. If you choose to keep the money in your former employer's plan, you won't be able to add any more money to the account, or, in most cases, take a (k) loan. If you meet the age requirement, you can begin making distributions from your former employer's (k) plan. While you won't be assessed a 10% penalty on these. Once your work with an employer ends, you can do a few things with your (k) plan. You could cash it out, roll it over to your new employer's (k). When you change employers, regulations make it easy for you to keep investing those savings tax-deferred, as long as you don't simply cash out. In addition. When you quit a job, your (k) stays where it is until you decide what to do with it. You can roll it over into your new (k), roll it into an IRA. If you are in a cash balance or (k)-type plan you will have the right to either leave your retirement money in your employer's plan when you leave the job or. Changing jobs is an exciting time, whether or not you're moving, and it can be a great opportunity to reevaluate what to do with your retirement savings. Other times, your money can't stay in the plan, and you need to take action, or your employer may move your money for you. The circumstances depend on the type. Yes. You can contact your previous brokerage company to transfer your k to your new k account. You can also roll over your previous k. If you choose to keep the money in your former employer's plan, you won't be able to add any more money to the account, or, in most cases, take a (k) loan. If you meet the age requirement, you can begin making distributions from your former employer's (k) plan. While you won't be assessed a 10% penalty on these.

Keep on track with your financial goals when changing jobs. · Stay in your plan · Roll over to your new employer's plan · Roll over to an IRA · Cash out. If you leave your employer for any reason or your employer decides they no longer want to offer a (k) plan, you will need to pay off your remaining loan. One option when you change jobs is simply to leave the funds in your old employer's (k) plan where they will continue to grow tax deferred. What happens to your (k) when you leave a job? Check in with your former employer to find out if you can leave the money in the retirement savings plan or. 1. Leave it in your current (k) plan. The pros: If your former employer allows it, you can leave your money where it is. · 2. Roll it into a new (k) plan. Fortunately, if you change jobs, you won't have to worry about losing your retirement plan. You have the option to roll over your (k) or (b) into a. Con #2: You may lose investment options. Your employer still controls what funds are offered, changed, or eliminated. Compare the fund offerings to your. What Should You Do With Your (k) When You Change Jobs? · Leave Your (k) With Your Previous Employer · Roll Over Your (k) to Your New Employer · Roll Over. However, you can rollover the offset amount to an eligible retirement plan. You have until the due date of your tax return, including extensions, to rollover. Check with your former employer to get the details. If your plan won't let you stay and your new job doesn't have a (k), your best bet is to do a direct. 1. Leave your savings with your current employer · 2. Roll over your savings into your new employer's (k) plan · 3. Roll over your savings into an IRA · 4. Cash. For starters, you typically won't be able to make additional contributions to this plan once you switch jobs. And, the plan administrator for your old employer. An employer-sponsored retirement plan may offer choices for what to do with your account balance in the plan when you decide to change jobs or retire. You can cash out your entire retirement plan balance when you leave an employer. But that could have a major impact on your savings—and your retirement. If you quit your job with an outstanding (k) loan, the IRS allows you up to the due date for federal tax returns for the following year plus any extensions. Just because you're leaving your job doesn't mean you have to also walk away from your employer's retirement plan. There may be some advantages to leaving money. Also, if you change jobs again in the future, you can continue to roll over balances into your existing IRA account. Keep in mind, when rolling stock into an. What happens to your (k) when you leave a job? Check in with your former employer to find out if you can leave the money in the retirement savings plan or. What Do I Get From My (k) Plan When I Leave? · Your pre-tax, after-tax, and Roth contributions · Any investment earnings · Employer contributions and earnings. You have access to the employer-matched funds in your (k) after leaving a job only if you are fully vested. If not fully vested, you may forfeit some or all.

Credit Score Specialist Near Me

credit score. Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving. Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri Work with a specialist. Our experienced specialists will help you every step. Our credit repair services help to fix your credit report. We have helped people take control of their financial lives from across the country. There might be a negative impact on your credit report and credit score. · Creditors might start debt collection. While you're in the debt settlement program you. Speak to a mortgage loan specialist about our products and services. Branch & ATM Locator. Branch. ATMs. Our guide takes you through all of the options for fixing your credit, including ways to improve your credit score and remove errors and certain negative items. For a list of approved credit counseling agencies by state and judicial district, select a state, US territory or commonwealth from the list below and then. We can help you achieve your financial goals, and it starts with a clean credit score. Call Go Clean Credit now to schedule a free consultation—we are #1 on the. We get it, credit scores are important. A monthly free credit score & Equifax credit report are available with Equifax Core CreditTM. No credit card required. credit score. Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving. Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri Work with a specialist. Our experienced specialists will help you every step. Our credit repair services help to fix your credit report. We have helped people take control of their financial lives from across the country. There might be a negative impact on your credit report and credit score. · Creditors might start debt collection. While you're in the debt settlement program you. Speak to a mortgage loan specialist about our products and services. Branch & ATM Locator. Branch. ATMs. Our guide takes you through all of the options for fixing your credit, including ways to improve your credit score and remove errors and certain negative items. For a list of approved credit counseling agencies by state and judicial district, select a state, US territory or commonwealth from the list below and then. We can help you achieve your financial goals, and it starts with a clean credit score. Call Go Clean Credit now to schedule a free consultation—we are #1 on the. We get it, credit scores are important. A monthly free credit score & Equifax credit report are available with Equifax Core CreditTM. No credit card required.

No one can remove correct information from your credit report, even if it negatively reflects on you. To locate a credit counseling service near you, go to. Links to topics below Credit Services Organization Application Search Credit Services Organization Registrants Credit Scores and Credit Reports Consumer. Speak to a Collections specialist Monday through Friday, 8 am to 9 pm, ET. +Rates are based on an evaluation of credit history, so your rate may differ. No impact on your credit score to apply2. No personal collateral required. US-based concierge service available around your schedule. Personal Loans; Business. $ 24 Hour Credit Repair Collection, Chargeoff, Late Pay, Repo, Bankruptcy, Inquiry Removal + more Delivery Time 1 day. Contact Capital One by phone for general customer service and support as well as support for credit cards, checking and savings, loans and investments. Working to fix incorrect credit limits that can inflate or skew credit utilization and adversely your credit score around and compare credit repair companies. Contact us about your membership, disputes, fraud & identity theft, or getting your credit report by phone. We're here to help with your credit needs. As CIBIL score improvement experts for individuals & businesses since ,Credit Help India has helped thousands of Indians in taking control of their. Learn about credit score. More Advice. Advice+ features · COVID support around the site. If you do not allow these cookies, we will not know when. Get credit reports and credit scores for businesses and consumers from Equifax today! We also have identity protection tools with daily monitoring and. We'll get your free credit report without harming your credit score. 2. Reviewing. A credit specialist will me a simple, yet straightforward plan. Thank. Call now to speak live with one of our dedicated specialists, and find out how to fix your credit (& reclaim your financial freedom), today! Close. Settings. Off English. Font Color. undefined. Font Opacity. %. Font That may, in turn, raise your credit score. You can take steps to repair. Working on credit, in a City near you You can talk to one of our credit specialists about your credit report and learn about the repair options available. Report Fraud · Regions & Offices. Search. Search. open menu icon close menu icon Menu Close. About. About · Regions & Offices · Program Mission · Bankruptcy. Talk to us about repairing your credit score. Take a positive step towards financial freedom. Speak to a specialist and receive credit repair assistance. The TransUnion Service Center is our free service where you can manage credit freezes, fraud alerts, disputes and your TransUnion credit report. Donald Stinson is a credit repair expert I met sometime last year when my cousin recommended him to me and the rest they say is history. The. Regardless of your credit score, or your previous credit history - bankruptcy, divorced, foreclosure, repossession, no credit, bad credit - we want to help! You.

Sas Vs Tableau Vs Power Bi

SAS Visual Analytics supports hierarchical data structures, allowing users to organize and analyze data at multiple levels. Unlike Tableau, SAS. In this Power BI vs Tableau tutorial, we are going to study what is Power BI and Tableau with Power BI vs Tableau. Moreover, we will discuss the benefits. We performed a comparison between Microsoft Power BI, SAS Visual Analytics, and Tableau based on real PeerSpot user reviews. Compare Power BI vs SAS Viya · Power BI. vs. SQL. Compare Power BI vs SQL · Power Compare Power BI vs Tableau · Power BI. vs. tool icon. Compare Power BI vs. I am SAS certified, Tableau certified and Power BI certified and I can say from personal experience, I found Power BI far less intuitive to. Reviewers felt that Microsoft Power BI meets the needs of their business better than SAS Enterprise Guide. · When comparing quality of ongoing product support. Tableau has a rating of stars with reviews. See side-by-side comparisons of product capabilities, customer experience, pros and cons, and reviewer. SAS Visual Analytics vs Tableau comparison SAS and Salesforce are both solutions in the Data Visualization category. SAS is ranked #11 with an average rating. PowerBI is a good tool and it brings insights but it requires sofisticated prerparation of data and is not as straight forward to use as people may want it to. SAS Visual Analytics supports hierarchical data structures, allowing users to organize and analyze data at multiple levels. Unlike Tableau, SAS. In this Power BI vs Tableau tutorial, we are going to study what is Power BI and Tableau with Power BI vs Tableau. Moreover, we will discuss the benefits. We performed a comparison between Microsoft Power BI, SAS Visual Analytics, and Tableau based on real PeerSpot user reviews. Compare Power BI vs SAS Viya · Power BI. vs. SQL. Compare Power BI vs SQL · Power Compare Power BI vs Tableau · Power BI. vs. tool icon. Compare Power BI vs. I am SAS certified, Tableau certified and Power BI certified and I can say from personal experience, I found Power BI far less intuitive to. Reviewers felt that Microsoft Power BI meets the needs of their business better than SAS Enterprise Guide. · When comparing quality of ongoing product support. Tableau has a rating of stars with reviews. See side-by-side comparisons of product capabilities, customer experience, pros and cons, and reviewer. SAS Visual Analytics vs Tableau comparison SAS and Salesforce are both solutions in the Data Visualization category. SAS is ranked #11 with an average rating. PowerBI is a good tool and it brings insights but it requires sofisticated prerparation of data and is not as straight forward to use as people may want it to.

Unsure of what to choose? Check Capterra to compare Tableau and SAS Visual Analytics based on pricing, features, product details, and verified reviews. In the head-to-head comparison between SAS and Tableau, both tools excel in distinct aspects of data visualization and analysis. Tableau's intuitive interface. Integration of data sources feels more robust and strict. Definitely a more classic or formal approach to data integration. In terms of visuals, Power BI is not. Compare Tableau vs SAS Visual Analytics for South African businesses. GetApp provides a side-by-side comparison with details on software price, features and. I am going to share my experience with three incredible visualization tools (Tableau, SAS Visual Analytics, and Microsoft PowerBi). Put simply, SaS is designed for statistical analysis where Tableau is designed for data visualization. SaS is terrible for data viz and Tableau. Tableau provides a wider range of visualization options and allows for more customization than Power BI. Tableau also supports interactive dashboards, making it. SAS Business Intelligence is praised for its powerful analytics capabilities, user-friendly interface, and ability to handle large datasets. Users appreciate. Tableau Software and SAS Data Integration Studio compete against each other in the Data Visualization, Analytics, Business Intelligence (BI), Dashboard, Data. Also, comparing it with other Business Intelligence tools like Tableau and Microsoft BI, the functionality of SAS BI is very limited and doesn't justify the. The top three of SAS Visual Analytics's competitors in the Data Visualization category are Microsoft Power BI with %, Tableau Software with %, D3js. Microsoft Power BI has reviews and a rating of / 5 stars vs SAS Visual Analytics which has 58 reviews and a rating of / 5 stars. Tableau, on the other hand, offers basic statistical functions and calculations but lacks the advanced statistical analysis capabilities that SAS provides. Tableau is the world's leading AI-powered analytics and business intelligence platform. Learn More! SAS® Visual Analytics enables reporting, data exploration. Apart from being a Business Intelligence tools, SAS Analytics Pro can be used as a data analysis tools and marketing analytics tools, while Tableau can be. Microsoft Power BI converts data into rich interactive visualizations, utilizing business analytics tools to share dashboard-based SAS® Visual Analytics. Decide which tool fits your needs in our in-depth comparison: Tableau vs. R Shiny: Which Excel Alternative Is Right For You? . TL;DR: This article compares R. Side-by-side comparison of Power Bi (76%), Tableau (90%) and MicroStrategy (87%) including features, pricing, scores, reviews & trends. Compare Alteryx vs Tableau vs Microsoft Power BI vs SAS Business Intelligence in Dashboard Software category based on reviews and features, pricing. Explore the differences between SAS Visual Analytics and Tableau in our comparison, focusing on data visualization and business intelligence.

Fitness Franchise Cost

Owning a gym franchise is worth the initial investment. Gym franchises currently account for $4B out of the total $34B health club industry in the US. Planet Fitness has the franchise fee of up to $20,, with total initial investment from $, Initial investments: $, - $4,, Net Worth. Two locations: $75,* · Three locations: $97,* · Four locations: $,* · Additional locations: $27, each. You can open your independent gym startup with an investment of $10, to $50, on average. Good locations can cost a lot. Although there is money in. But if you're looking for a franchise that offers affordable membership and equipment, Planet Fitness is the way to go. So, how much does it cost to open a. If you are considering opening a kickboxing gym, then 9Round should be your choice. Initial investment requirement varies from $,00 to $, With the. I understand that the Estimated Initial Investment to open a new Snap Fitness Club is $, – $1,, Please see Item 7 of the FDD for full details. The Camp Transformation Center is a low-cost fitness franchise with a simple business to manage. The franchisor handles lead generation for franchisees. A typical F45 franchise requires an initial investment of approximately $50, – $,, which includes the franchise fee, initial equipment, and marketing. Owning a gym franchise is worth the initial investment. Gym franchises currently account for $4B out of the total $34B health club industry in the US. Planet Fitness has the franchise fee of up to $20,, with total initial investment from $, Initial investments: $, - $4,, Net Worth. Two locations: $75,* · Three locations: $97,* · Four locations: $,* · Additional locations: $27, each. You can open your independent gym startup with an investment of $10, to $50, on average. Good locations can cost a lot. Although there is money in. But if you're looking for a franchise that offers affordable membership and equipment, Planet Fitness is the way to go. So, how much does it cost to open a. If you are considering opening a kickboxing gym, then 9Round should be your choice. Initial investment requirement varies from $,00 to $, With the. I understand that the Estimated Initial Investment to open a new Snap Fitness Club is $, – $1,, Please see Item 7 of the FDD for full details. The Camp Transformation Center is a low-cost fitness franchise with a simple business to manage. The franchisor handles lead generation for franchisees. A typical F45 franchise requires an initial investment of approximately $50, – $,, which includes the franchise fee, initial equipment, and marketing.

Interested in a Franchise? We are currently accepting applications for international territories. We require a minimum of $33MM of non-borrowed liquid assets. Ready for a knockout opportunity? Build the future you want with an affordable, high-performance franchise. The initial investment required to open an Anytime Fitness franchise varies depending on factors such as location and size of the gym. However. The FMT Fitness Franchise initial investment can be from $ up to $ Get in touch with us to open your own fitness franchise! Crunch offers the most bang-for-the-buck! For $, members get access to state-of-the-art equipment, locker rooms and one complimentary CrunchONE Kickoff. What Does an Anytime Fitness Franchise Cost? To buy a franchise with Anytime Fitness, you'll need to have at least liquid capital of $, Franchisees can. Planet Fitness Franchise Cost, Total Investment and Requirements. Franchise Income. Planet Fitness's franchise fee is $10, for a year renewable agreement. We attract Master Franchisees and Area Developers with a range of skills from leadership, to retail and operations, to sales and finance. Opening costs start around $k, including a modest $39, franchise fee – well below industry averages. Financing available. a more FLEXIble franchise model. How much does it cost to become an Amped Fitness® franchisee? All-in start-up costs range from about $, - $3,, (Average Investment is $1,,). What funds are required? When you open a Workout Anytime franchise, we require you to have $k of liquid capital, and a net worth of at least $k. In our. The Base Costs of Starting a Gym Franchise. Investment costs will vary depending on the company you choose. Franchises like Jazzercise have an initial fee as. Opening costs start around $k, including a modest $39, franchise fee – well below industry averages. Financing available. a more FLEXIble franchise model. If you are considering opening a kickboxing gym, then 9Round should be your choice. Initial investment requirement varies from $,00 to $, With the. In this article, we look at what exactly a gym franchise is, the current state of the fitness industry and list 9 of the best gym franchise opportunities this. The La Fitness franchise cost consists of several elements. In order to acquire a franchise, entrepreneurs need to cover a La Fitness franchise fee of $15,$. Top 10 Fitness Franchises · GYMGUYZ · Alloy Personal Training · IV Nutrition · Soccer Stars · Tippi Toes · Beem Light Sauna · Stretch Zone · The Exercise Coach. The minimum cash required can run upwards of $, or $, for a gym, and the initial franchise fee can range from $30,$60, itself. You also have. Ready for a knockout opportunity? Build the future you want with an affordable, high-performance franchise.

Capital One Double Cash Back

What card is better capital one quicksilver or Citi double cash? · Rewards? - 2% > %, so Citi · Customer Service? - General consensus seems. This popular cash back card takes the hassle out of credit card rewards. With unlimited % Cash Back on every purchase, every day and no rotating categories. Earn unlimited 2% cash back on every purchase you make with the Spark Cash Plus pay-in-full business credit card from Capital One. Apply online today. Cash back: 1% on all purchases, 3% on dining, entertainment, popular streaming services, and grocery store purchases, 10% on Uber and Uber Eats purchases, 8% on. It's basically a 2% cashback credit card that forces you to make payments to get the full 2%. You will earn $ for every dollar you spend. The Citi Double Cash Card is a cash-back credit card known for its simple yet effective rewards structure. Cardholders can earn cash-back twice. Earn 5% cash back on your top eligible spend category each billing cycle up to $ spent. 2 Earn 1% cash back thereafter on all other purchases. One of the few cards to earn our coveted 5-star rating, the Citi® Double Cash Card offers unlimited 2% cash back on every purchase, split up as 1% when you make. Earn $ cash back after you spend $1, on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20, ThankYou® Points. What card is better capital one quicksilver or Citi double cash? · Rewards? - 2% > %, so Citi · Customer Service? - General consensus seems. This popular cash back card takes the hassle out of credit card rewards. With unlimited % Cash Back on every purchase, every day and no rotating categories. Earn unlimited 2% cash back on every purchase you make with the Spark Cash Plus pay-in-full business credit card from Capital One. Apply online today. Cash back: 1% on all purchases, 3% on dining, entertainment, popular streaming services, and grocery store purchases, 10% on Uber and Uber Eats purchases, 8% on. It's basically a 2% cashback credit card that forces you to make payments to get the full 2%. You will earn $ for every dollar you spend. The Citi Double Cash Card is a cash-back credit card known for its simple yet effective rewards structure. Cardholders can earn cash-back twice. Earn 5% cash back on your top eligible spend category each billing cycle up to $ spent. 2 Earn 1% cash back thereafter on all other purchases. One of the few cards to earn our coveted 5-star rating, the Citi® Double Cash Card offers unlimited 2% cash back on every purchase, split up as 1% when you make. Earn $ cash back after you spend $1, on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20, ThankYou® Points.

Enjoy $ to use on Capital One Travel in your first cardholder year, plus earn 75, bonus miles once you spend $4, on purchases within the first 3. Earn 10% cashback on Uber and Uber Eats, 8% on Capital One Entertainment purchases, 5% on hotels and rental cars, 3% on dining and grocery stores. Intro offer. The Citi Double Cash® Card is an alternative card that offers flat-rate cash back on qualifying purchases. You'll earn 1% cash back when you make a purchase and. The no-frills Capital One QuicksilverOne Cash Rewards Credit Card offers an unlimited % cash back on every purchase; plus 5% unlimited cash back on hotels. Earning Rewards With the Citi Double Cash · Unlimited 1% cash back when you buy, plus an additional 1% as you pay · 5% total cash back on hotels, car rentals and. Unlimited % Cash Back on every purchase, every day. Plus, get access to valuable benefits. · Unlimited Rewards · Annual Fee · Purchase Rate. Great perks, the card fees pay are easily made back through the credits and miles awarded and capital one travel has saved me a bunch with great deals. Yes, I. Earn % cash back on every purchase with a refundable $ minimum deposit. NEW CARD MEMBER OFFER. Earn a one-time $ cash bonus once you spend $ on. 1% Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back. Capital One Quicksilver Cash Rewards Credit Card offers unlimited % cash back on all purchases - making it a simple cash back card that rewards you on every. The Citi Double Cash Card is one of the most rewarding cash back credit cards with no annual fee. If offers unlimited cash back and comes with one of the. They both offer unlimited % cash back on every purchase, every day. But there are elevated rewards for cardholders on Capital One Travel. SavorOne has tiered. Earn cash back rewards with Capital One Quicksilver cards · Capital One Quicksilver rewards credit card: With Quicksilver, you'll earn unlimited % cash back. Widely regarded as one of the best cash back credit cards on the market for everyday spend, the Citi Double Cash® Card earns 2% cash back. The Citi Double Cash® Card can be a great card for everyday purchases, thanks to its straightforward cash back program and $0 annual fee. The citi card has 2% cash back for every purchase. so, is it better for me to get the capital one card to save on foreign transactions or get the citi card for. No rotating categories or sign-ups needed to earn cash rewards · Cash back won't expire for the life of the account and there's no limit to how much you can earn. Rewards Rate. Unlimited % Cash Back on every purchase, every day; 5% Cash Back on hotels and rental cars booked through Capital One Travel (terms apply). Forget tracking spending or juggling multiple cards or bonus categories – the Citi Double Cash Card gets you up to 2% cash back on all purchases (1% when you. The Citi Double Cash card is a no-annual-fee powerhouse that offers two points per dollar for all purchases. Points can be simply cashed out so as to make this.

Cash Flow For New Business

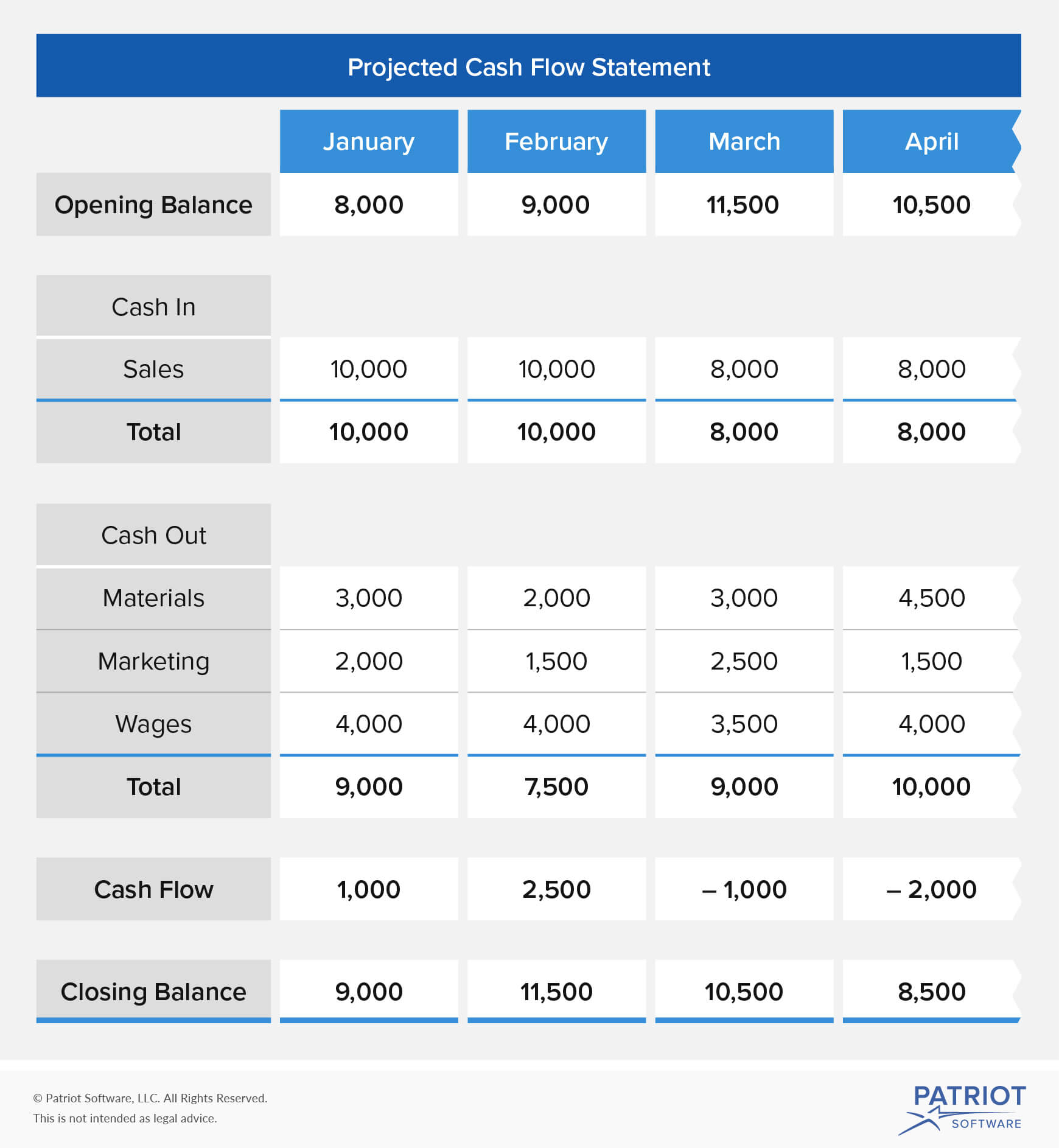

Cash flow statements can be prepared monthly, quarterly, yearly, or for any period you determine to be most helpful. Most businesses find keeping track each. As well as your business plan, a set of financial statements detailing you cashflow is essential. This will provide details of actual cash required by your. Small business owners must understand what the “flow” of cash means. Cash flow refers to the total amount of money flowing into and out of a business over time. 10 Profitable Cash Flow Businesses in · SaaS Business · Digital Courses · Blogging · YouTube Channel · Real Estate and Rentals · Car Wash · Healthcare and Social. Managing cash in times of growth · each sale made must be funded by working capital (available cash) · a business must carry stock (materials and finished. You can implement seven simple steps to create an effective cash flow management process that aligns with bookkeeping best practices. A cash flow statement is a document that highlights the cash inflows and outflows of a business to enable each cash management. Without positive cash flow, a business may struggle to pay its bills on time, meet payroll expectations, or invest in new opportunities the moment they come. Need to create a cash flow statement for your startup business? The Startup Series has everything you need to know about making a CFS. Cash flow statements can be prepared monthly, quarterly, yearly, or for any period you determine to be most helpful. Most businesses find keeping track each. As well as your business plan, a set of financial statements detailing you cashflow is essential. This will provide details of actual cash required by your. Small business owners must understand what the “flow” of cash means. Cash flow refers to the total amount of money flowing into and out of a business over time. 10 Profitable Cash Flow Businesses in · SaaS Business · Digital Courses · Blogging · YouTube Channel · Real Estate and Rentals · Car Wash · Healthcare and Social. Managing cash in times of growth · each sale made must be funded by working capital (available cash) · a business must carry stock (materials and finished. You can implement seven simple steps to create an effective cash flow management process that aligns with bookkeeping best practices. A cash flow statement is a document that highlights the cash inflows and outflows of a business to enable each cash management. Without positive cash flow, a business may struggle to pay its bills on time, meet payroll expectations, or invest in new opportunities the moment they come. Need to create a cash flow statement for your startup business? The Startup Series has everything you need to know about making a CFS.

For a small business, unreliable cash flow can be catastrophic. Each year, poor cash flow forces many small businesses to close. Even a short-term cash flow. Here we detail why managing a healthy cash flow is critical for a successful startup and how to calculate cash flow forecasts with a step-by-step guide. By implementing cash flow forecasting, you'll have enough time to plan and rein in your expenses or even look into leveraging a small business line of credit to. Businesses report their profits in their income statement—also known as a profit and loss statement (P&L). This financial document explains your startup's. 1. Decide how far out you want to plan for · 2. List all your income · 3. List all your outgoings · 4. Work out your running cash flow. For example, if your company has $, cash inflow and $, cash outflow, the calculation would be as follows: $, (cash inflow) − $, (cash. At the most basic level, cash flow is the relationship between money coming into your company and money flowing out of it. Think of an entrepreneurial business. If you don't have enough cash on hand to replenish inventory or pay operating expenses, you will become unable to generate new sales. If you can't afford. Cash flow measures how much cash a company takes in versus how much it expends. More cash coming in than going out means the cash flow is positive. When you have positive cash flow, you're making enough money to cover your bills and even reinvest in your business, expanding operations and hiring new. Free cash flow refers to the resources available for distribution among all the stakeholders in the company. It shows you how much capital you have to reinvest. Today we're going to lift up the hood and look at one of the most important of these business details: managing cash flow. Especially for early startups. If you don't have enough cash on hand to replenish inventory or pay operating expenses, you will become unable to generate new sales. If you can't afford. Step 1. Enter Your Beginning Balance. For the first month, start your projection with the actual amount of cash your business will have in your bank account. Cash flow is extremely important for new businesses, not only to bring in operating capital while they're trying to build up revenues, but also to cover. Having a positive cash flow means that more money is coming into the business than going out. It's just as important as profit when it comes to determining. To do a cash flow analysis, you'll need your cash flow statement, which should include your business income and expenses on a monthly or yearly basis. Cash flow refers to the intake and output of money within a business. It encompasses all the revenues and expenses of a company at a given moment in time. Cash. If a company cannot purchase new inventory, it will slowly become unable to generate new sales. If a company cannot afford its operating expenses, it will. While there are multiple factors to consider with cash flow depending on industry and the lifecycle stage of your company, one key is relevant to all small.

Chainalysis Company

![]()

Chainalysis offers cryptocurrency investigation and compliance solutions to global law enforcement agencies. company in the blockchain analysis and cryptocurrency compliance sector. Company Overview. Chainalysis' mission is to build trust in blockchains and create. Chainalysis is an American blockchain analysis firm headquartered in New York City. The company was co-founded by Michael Gronager, Jan Møller and. Chainalysis is hiring on Otta. See employee endorsements, gender The company markets its products largely towards enterprise companies, banks. Chainalysis is one of the fastest growing companies in the cryptocurrency space. Our cryptocurrency investigation and compliance software is used by the world'. Chainalysis offers cryptocurrency investigation and compliance solutions to global law enforcement agencies, regulators, and businesses as they work together to. Chainalysis designs and develops anti-money laundering software for Bitcoin businesses. Its products include REACTOR, an interactive investigation tool that. The company's data powers investigation, compliance, and market intelligence software that has been used to solve some of the world's most high-profile criminal. Chainalysis is a blockchain analytics company that provides data and analysis to government agencies, financial institutions, and cryptocurrency businesses. Chainalysis offers cryptocurrency investigation and compliance solutions to global law enforcement agencies. company in the blockchain analysis and cryptocurrency compliance sector. Company Overview. Chainalysis' mission is to build trust in blockchains and create. Chainalysis is an American blockchain analysis firm headquartered in New York City. The company was co-founded by Michael Gronager, Jan Møller and. Chainalysis is hiring on Otta. See employee endorsements, gender The company markets its products largely towards enterprise companies, banks. Chainalysis is one of the fastest growing companies in the cryptocurrency space. Our cryptocurrency investigation and compliance software is used by the world'. Chainalysis offers cryptocurrency investigation and compliance solutions to global law enforcement agencies, regulators, and businesses as they work together to. Chainalysis designs and develops anti-money laundering software for Bitcoin businesses. Its products include REACTOR, an interactive investigation tool that. The company's data powers investigation, compliance, and market intelligence software that has been used to solve some of the world's most high-profile criminal. Chainalysis is a blockchain analytics company that provides data and analysis to government agencies, financial institutions, and cryptocurrency businesses.

Chainalysis Inc. is a for-profit cybersecurity and blockchain analytics company based in New York that provides cryptocurrency investigation software and. The company offers solutions for crypto investigations, regulatory compliance, and market intelligence, enabling businesses, financial institutions, and. Chainalysis overview · daliweb.site · New York, NY · to Employees · 7 Locations · Type: Company - Private · Founded in · Revenue: Unknown / Non-. Chainalysis provides data, software, services, and research to government agencies, exchanges, financial institutions, and insurance and cybersecurity companies. Chainalysis uses on-chain data to trace crypto transactions, identifying scams, hacks, fraud and illicit activity involving digital assets. Learn about Chainalysis's company culture, core values, latest hiring news, and evaluate if it's a potential fit for your next workplace. What company do you own stock or options in? How many shares or options do you own? Chainalysis is a System for blockchain analysis company with 61 job openings. It is currently valued at $ billion as a private company. Chainalysis is the blockchain analysis company. We provide data, software, services, and research to government agencies, exchanges, financial institutions. Despite the broader crypto market downturn, Chainalysis has continued to grow due to its focus on compliance software and investigative tools. The company's. Chainalysis Inc. operates as a blockchain data platform. The Company provides data, software, services, and research to government agencies, exchanges. Chainalysis Inc. operates as a blockchain data platform. The Company provides data, software, services, and research to government agencies, exchanges. Information on valuation, funding, cap tables, investors, and executives for Chainalysis. Use the PitchBook Platform to explore the full profile. Company Profile: Chainalysis is a blockchain data platform. Chainalysis provides data, software, services, and research to government agencies, exchanges. Chainalysis has 5 employees across 5 locations and $ m in total funding,. See insights on Chainalysis including office locations, competitors, revenue. We provide data, software, services, and research to government agencies, exchanges, financial institutions, and insurance and cybersecurity companies in over. Chainalysis offers cryptocurrency investigation and compliance solutions to global law enforcement agencies, regulators, and businesses. Chainalysis, the leader in blockchain intelligence, makes it easy to connect An update on the UK's Economic Crime and Corporate Transparency Act (ECCT). Chainalysis provides data, software, services, and research to government agencies, exchanges, financial institutions, insurers, and cybersecurity companies in. Chainalysis, Inc. is a privately-held company that provides cryptocurrency investigation and compliance services to global law enforcement agencies.

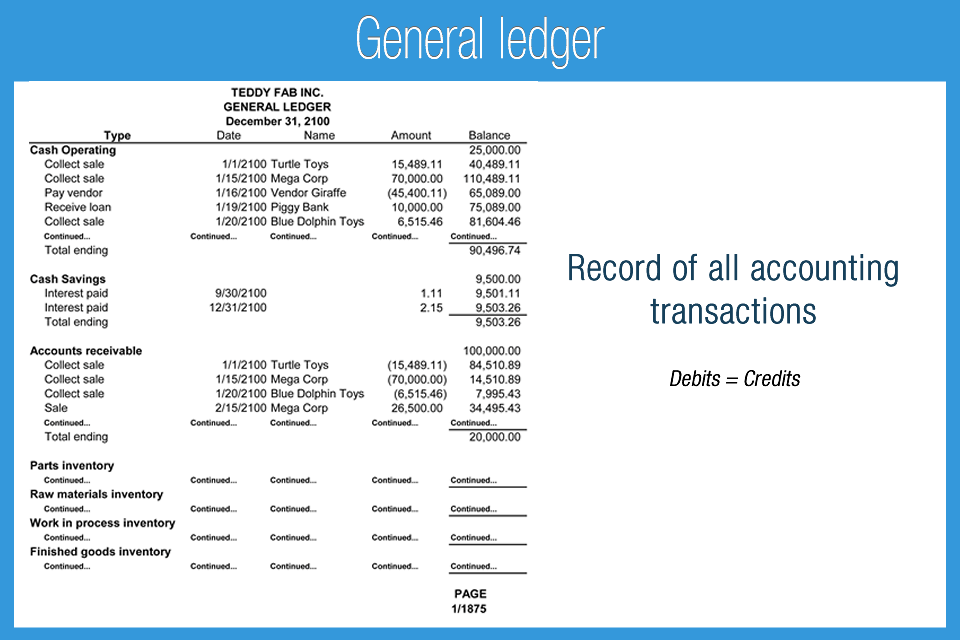

Whats A General Ledger

What Is a General Ledger? A general ledger is an accounting system you can implement to track your company's debit and credit transactions, along with. A general ledger is a record of your company's complete portfolio of financial accounts. Also known as a GL, your general ledger holds all of the. A general ledger (GL) is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports. A general ledger, or GL, is a means for keeping record of a company's total financial accounts. It provides businesses a record of each financial transaction. A ledger (also called a general ledger, accounting ledger, or financial ledger) is a record-keeping system for a company's financial transaction data. How a general ledger works. General ledgers use the double-entry accounting method, with each transaction in the ledger recorded in two columns, one for debit. A general ledger is a bookkeeping ledger in which accounting data are posted from journals and aggregated from subledgers. A general ledger is a grouping of perhaps hundreds of accounts that are used to sort and store information from a company's business transactions. General Ledger Accounts (GLs) are account numbers used to categorize types of financial transactions. Most commonly used GLs are revenues, expenses and. What Is a General Ledger? A general ledger is an accounting system you can implement to track your company's debit and credit transactions, along with. A general ledger is a record of your company's complete portfolio of financial accounts. Also known as a GL, your general ledger holds all of the. A general ledger (GL) is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports. A general ledger, or GL, is a means for keeping record of a company's total financial accounts. It provides businesses a record of each financial transaction. A ledger (also called a general ledger, accounting ledger, or financial ledger) is a record-keeping system for a company's financial transaction data. How a general ledger works. General ledgers use the double-entry accounting method, with each transaction in the ledger recorded in two columns, one for debit. A general ledger is a bookkeeping ledger in which accounting data are posted from journals and aggregated from subledgers. A general ledger is a grouping of perhaps hundreds of accounts that are used to sort and store information from a company's business transactions. General Ledger Accounts (GLs) are account numbers used to categorize types of financial transactions. Most commonly used GLs are revenues, expenses and.

A General Ledger (GL) is a record of all past transactions of a company, organized by accounts. Each General Ledger account contains debit and credit. General ledger account, or GL accounts, are unique numbered accounts that are used to store, summarize, and sort a company's transactions. They are maintained. A general ledger is the foundation of a company's financial reporting, with all company transactions recorded. It includes things like assets (fixed and current). A general ledger is a central repository in an accounting system that captures and organizes all transactions. In accounting, a General Ledger (GL) is a record of all past transactions of a company, organized by accounts. General Ledger (GL) accounts. General Ledger Account Definitions · ASSETS · LIABILITIES AND FUND EQUITY · REVENUE · EXPENSE · Accounting Home. What is a GL code? A general ledger or GL code is a unique identification code that allows businesses to classify and track their financial activity. It helps. The general ledger is the master record of every financial transaction you make as part of your business. What is a general ledger? A general ledger is a record of a company's transactions. Typically, it measures debits and credits, assets and liabilities, and. A general ledger (GL) is the means by which a business keeps a record of its total financial accounts. It will typically include assets, liabilities, equity. In bookkeeping, a general ledger is a bookkeeping ledger in which accounting data are posted from journals and aggregated from subledgers, such as accounts. Key Takeaways · The journal consists of raw accounting entries that record business transactions, in sequential order by date. · The general ledger is more. A general ledger account is an account or record used to sort, store and summarize a company's transactions. What is a General Ledger Account? · A general ledger account (GLA) is the first element of an · A company's balance sheet and profit and loss statement are both. A general ledger is an accounting system companies use to record, organize, and monitor all financial transactions. A general ledger account is an account or record used to sort, store and summarize a company's transactions. A general ledger, or GL, is where an organization keeps its financial data. It helps to maintain records, track activities, and generate statements. A general ledger uses a double-entry accounting method to count credit and debit transactions. Credit transactions are transactions charged against a business. A general ledger is a centralized record of financial transactions within an organization, serving as a repository for all accounting data. The General Ledger System enables businesses to record all transactions in one place, providing a clear overview of the company's financial position. This.

Types Of Parlay Bets

A parlay is a bet that combines two or more single wagers into one bet, increasing the payout with each additional bet - the more bets added to the parlay, the. Parlays combine multiple wagers into a single bet, usually increasing the odds and making for a higher possible payout. The catch? Every single leg of a parlay. Parlay picks can be based on any market: Moneyline, Point Spread, Over/Under, or any type of Prop Bet. Successful Parlay Bets can pay out large. Why? The more. The beauty of parlay betting is that it offers choice. Dozens of sports and bet types can all be combined on a single ticket. Here at Bally Bet, we offer. For a single bet, you can choose the market you want and place it. Your winnings are calculated based on your stake and the odds at the time of the bet. Parlay bets are made up of multiple different betting markets. Parlays can include anywhere from two events up to however many the sportsbook. In the simplest language, a parlay bet is a single wager that involves two or more athletes or teams involved in a sporting event. A parlay is like a sports betting combo meal – instead of just one pick, you bundle several bets on different games into one package. A parlay bet is a single wager that involves two or more athletes or teams involved in a sporting event. A parlay is a bet that combines two or more single wagers into one bet, increasing the payout with each additional bet - the more bets added to the parlay, the. Parlays combine multiple wagers into a single bet, usually increasing the odds and making for a higher possible payout. The catch? Every single leg of a parlay. Parlay picks can be based on any market: Moneyline, Point Spread, Over/Under, or any type of Prop Bet. Successful Parlay Bets can pay out large. Why? The more. The beauty of parlay betting is that it offers choice. Dozens of sports and bet types can all be combined on a single ticket. Here at Bally Bet, we offer. For a single bet, you can choose the market you want and place it. Your winnings are calculated based on your stake and the odds at the time of the bet. Parlay bets are made up of multiple different betting markets. Parlays can include anywhere from two events up to however many the sportsbook. In the simplest language, a parlay bet is a single wager that involves two or more athletes or teams involved in a sporting event. A parlay is like a sports betting combo meal – instead of just one pick, you bundle several bets on different games into one package. A parlay bet is a single wager that involves two or more athletes or teams involved in a sporting event.

A three-team Over/Under football parlay bet offers odds at + and a potential payout of $ on a $ single bet. Can you parlay different football bet types. Some common types of parlays include point spread parlays, moneyline parlays type of parlay bet, the “same-game parlay”. Simply put, this is where you. Some sports books offer pre-made teaser and parlay cards that you can fill out prior to getting to the betting window. The most common type of these betting. For a single bet, you can choose the market you want and place it. Your winnings are calculated based on your stake and the odds at the time of the bet. A parlay, accumulator (or acca), combo bet, or multi is a single bet that links together two or more individual wagers, usually seen in sports betting. Parlay betting is a common way to bet on sports that allows you to raise the stakes for larger payouts. To place a parlay bet, you can combine the odds for. What is a Parlay Bet & How Does It Work? For sports bettors, parlays are combination bets that involve folding several discrete wagers into a single. What is Parlay Betting? · 2-Leg Parlay. Bet #1: Moneyline @ + Bet #2: Over points @ Overall odds: + · 3-Leg Parlay. Bet #1: Moneyline @ NFL parlays are a specific type of wager that enables bettors to combine multiple individual bets into one consolidated bet. For the entire parlay to be. A parlay is considered a single sports wager that includes two or more bets combined into one. The bet can include any kind of wager like point spreads. Types of parlay bets Parlay bets always involve two or more bets combined together for a bigger singular payout. However, there are variations of parlay. A parlay is a sports bet that combines several individual wagers into one single bet. In most cases, for the parlay to payout, you need all of the separate. A parlay bet is a single wager that combines two or more individual bets into one. · Some parlays are more difficult to achieve than others. · Parlaying. Parlay bets: When a bettor makes two or more bets and combines them into one wager, it's called a parlay bet (or an "accumulator" or "multi"). This type of bet. A parlay is sometimes called "accumulators" or "multis." Thankfully, no matter what the moniker of this type of bet is, it is a form of gambling that has a. Sportsbooks and casinos use parlays to let combine the three general-bet forms of wagers into one bet. These include the moneyline, Over/Under, and point. Types of parlays. There are common types of parlay bets that you will encounter: teasers, accumulators, round robin, progressives, and conditional parlays. Each. What are the odds of hitting a parlay? · Two-team parlay – percent · Three-team parlay – percent · Four-team parlay – percent · Five-team parlay –. A type of parlay in which the pointspread or total of each individual play is adjusted. The price of moving the pointspread (teasing) is lower payoff odds on. 51 votes, comments. K subscribers in the sportsbook community. nfl sports betting picks, sports picks and betting, pick of the day.